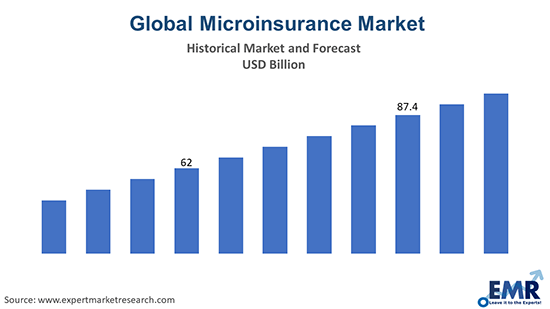

The global microinsurance market size was around USD 82.87 billion in 2023. The industry is further expected to grow at a CAGR of 6.5% over the forecast period of 2024-2032 to attain a value of around USD 145.91 billion by 2032.

The global microinsurance market is being driven by the growing insurance industry and rapid digitalisation, ensuring transparency between the consumers and service providers. The commercially viable microinsurance segment, among other service providers, accounts for the majority of the total market share.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Region-wise, the Asia Pacific holds the leading position in the market owing to the presence of a large population and favourable government initiatives. Within the Asia Pacific, continuous improvements in regulatory policies, especially in developing nations, is expected to create a positive outlook for the industry. For instance, the Insurance Regulatory and Development Authority of India (IRDAI), in a bid to increase the penetration of insurance in the country, permitted the distribution of all microinsurance products through point-of-sales (PoS) in 2018. The governments in such regions are framing policies to raise competitiveness, promoting innovation, and contributing to the economic growth by encouraging customers to take up microinsurance products and making banking easier and more accessible. Such trends are expected to contribute to the global microinsurance market growth over the forecast period.

A part of microfinance, microinsurance is a type of insurance coverage offered to low-income sections of the society. It wholly or partially reimburses the medical and various other needs of the individuals belonging to the financially weaker section with low premiums and a tailored scheme. Thus, it provides customers compensation for an injury, illness, disabilities, death, and various property risks.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

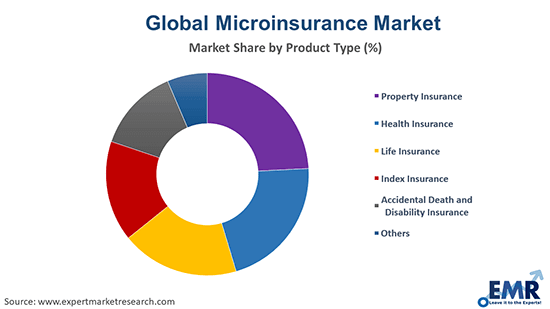

The microinsurance market segmentation, based on product type, is as follows:

On the basis of provider, the microinsurance market has been categorised into:

On the basis of model type, the microinsurance market has been categorised into:

The regional markets for the product include North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The global microinsurance market is being driven by the implementation of favourable government initiatives, the growing insurance industry, and rising awareness regarding insurance programmes among consumers. The growing prevalence of busy and sedentary lifestyles is leading to the growth in incidences of obesity and diabetes across the globe. This is creating a need for microinsurance, which can cover the growing medical expenses. The launch of affordable insurance plans, which can further be customised to fulfil customers’ requirements, is contributing to the industry growth. The development of novel programmes by the leading players in the industry, aimed at providing a safeguard against exorbitant medical bills to the consumers, is expected to aid the microinsurance market growth over the forecast period.

Microinsurance is increasingly being preferred owing to its affordability and transparent dynamics, which aids the consumers. Also, several organisations are employing multichannel platforms and virtual networks to provide incentives and build a value chain in the microinsurance business. Further, the advent of consumer-friendly insurance models, like the peer-to-peer model, is also providing a thrust to the microinsurance market growth. Several companies are increasingly adopting automated portfolio monitoring, which keeps them updated about the credit flow of their client segment and allows them to keep track and take appropriate steps with immediate effect. This helps the microinsurance companies to minimise their risks and propel better revenues and profits. Such factors are anticipated to boost the industry growth in the future.

The report also gives a detailed analysis of the major key players in the global microinsurance market, covering their competitive landscape, capacity, and latest developments like mergers and acquisitions, investments, capacity expansion, and plant turnarounds. The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis.

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment: