Custom Choice Loans, powered by Cognition Financial, offers borrowers competitive loan products that can be tailored to fit their needs while in school and after graduation.

Cognition Financial was founded in 1991 with “the goal of helping students reach their educational goals through access to funding”. Since then, it facilitated more than $23 billion in private student loans and helped more than 1 million families pay for education costs.

It previously partnered with SunTrust Bank to provide private student loans, but that lender has since halted its student loan program.

As of July 2020, Cognition Financial partners with Citizens

to serve as the funding source for its Custom Choice student loan program.

Read on for our Custom Choice Loan review which includes a breakdown of its rates, terms, and application process.

Custom Loans are available to undergraduate and graduate students enrolled at least half-time at an eligible school.

Here’s a brief overview of what to expect with Custom Choice Loans.

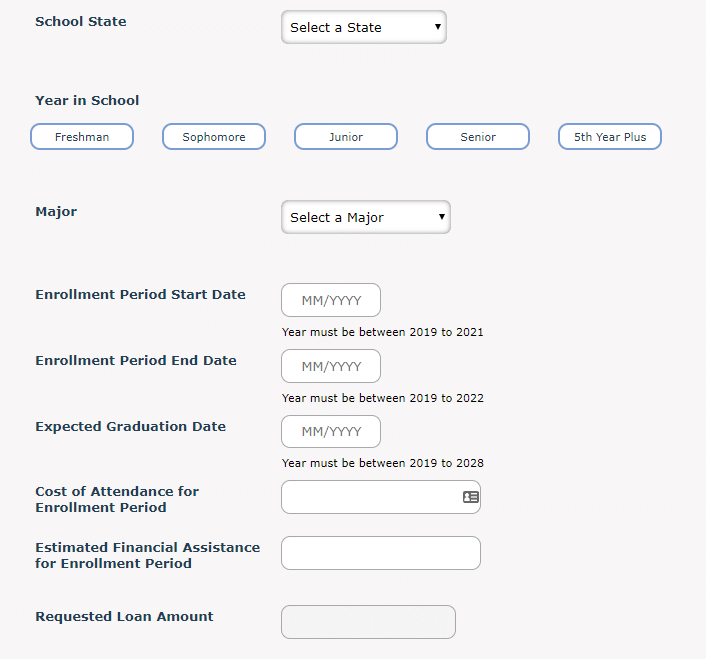

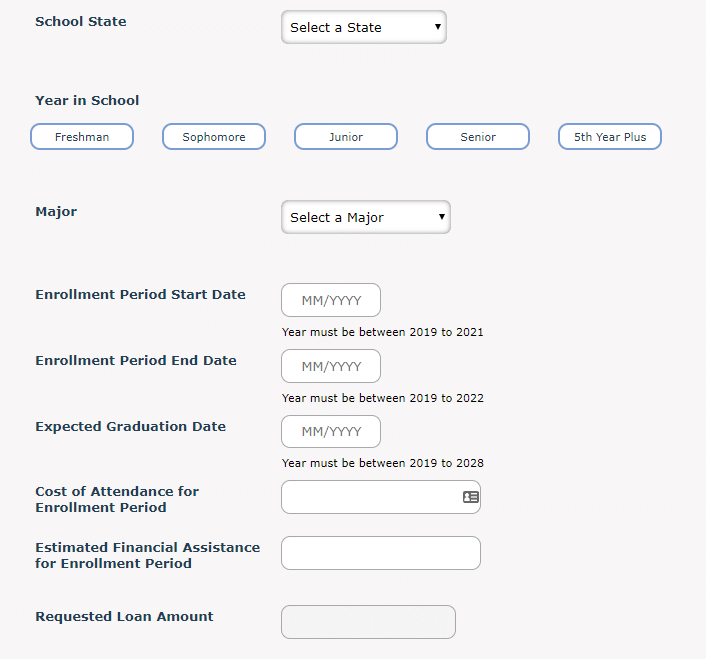

You’ll enter detailed information, including the formal name of your school and major. Be prepared to input your academic period, expected graduation date and requested loan amount.

If you’re applying on your own, you’re required to provide income information (e.g. source and amount). Otherwise, only the cosigner needs to show proof of income, along with their personal information details.

Private student loans should only be used to fill any financial gaps that are left after exhausting grants, scholarships and other financial aid opportunities.

If you still need private student loans, we recommend shopping around with at least three private student loan lenders. Start by reviewing the top private student loan lenders. And check your rates with Custom Choice since it won’t affect your credit.

Custom Choice Loans already offers competitive rates. But you might get a better deal if you add a cosigner and take advantage of the lender’s multiple interest rate discount programs.

This is especially true for upperclassmen that feel confident in their graduation date since they can earn a full 2% reduction — on top of any other autopay or promotional discounts.